topics

- Home

- Recommendations

- AWS Savings Plan Management

Create and View Savings Plan Recommendations for Single Accounts

January 7, 2025

Savings Plan recommendations for single accounts generates a recommendation based on the data in one or more single accounts. Using this option can help you empower teams to make their own decisions about Savings Plans, but may not be the most efficient option for the organization as a whole.

Create a Savings Plan Recommendation for Single Accounts

CloudHealth creates a Savings Plan hourly commitment recommendation based on usage data from a specified billing account or multiple specific accounts, for a specified period of time.

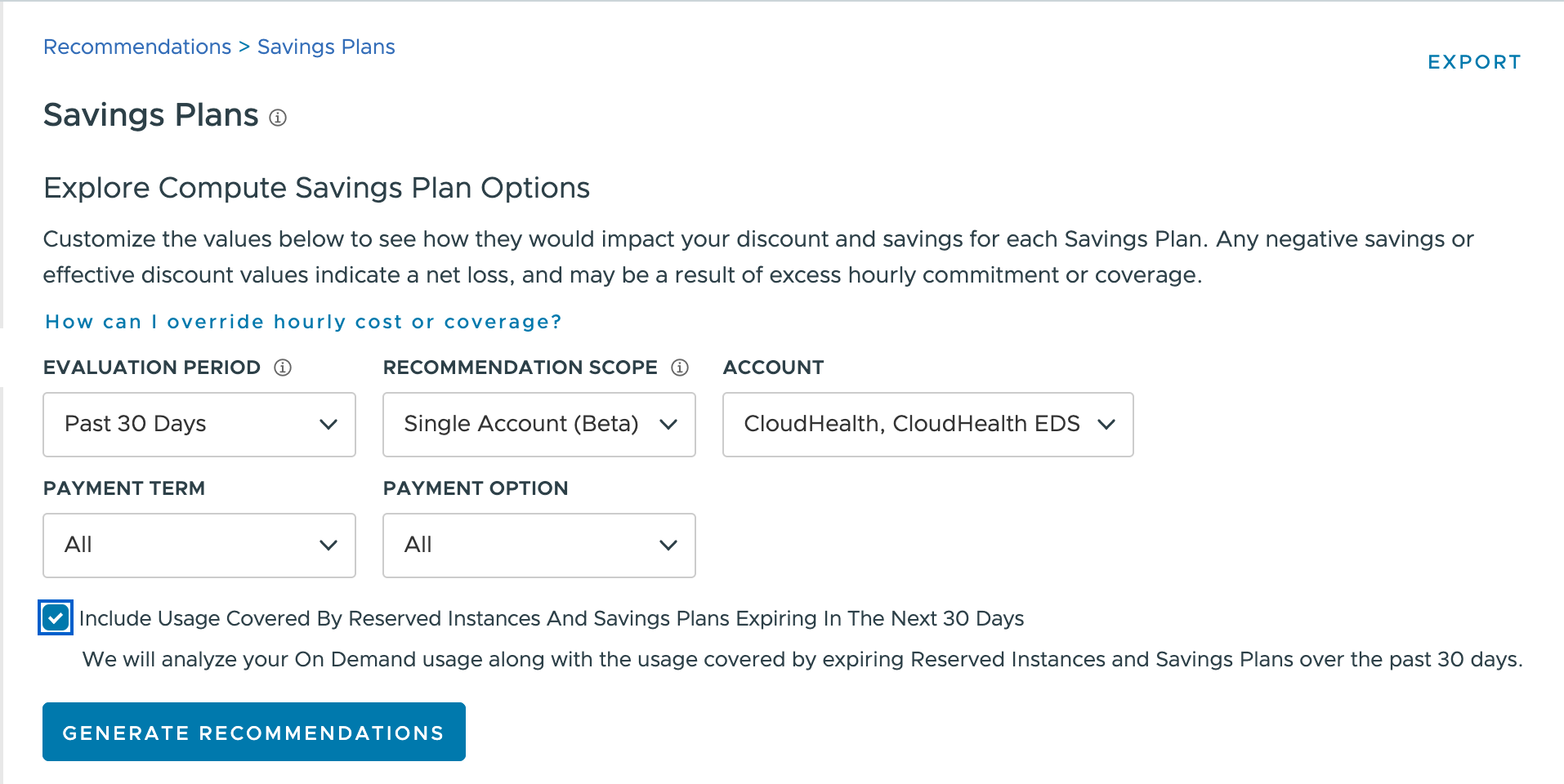

To create a recommendation, go to Recommendations > Savings Plans, and specify the recommendation constraints:

- Evaluation Period: the time frame of existing usage from which the recommendation is built. Select the evaluation period that best resembles future usage trends. For example, if your usage follows certain monthly patterns, select an evaluation period of 30 days instead of 7 days.

- Recommendation Scope: Select Single Account

- Account: select one or more accounts from which usage data is analyzed.

- Payment Term: the desired payment term for the recommendation, either 1 year or 3 years.

- Payment Option: the desired payment option: All Upfront, Partial Upfront, or No Upfront.

- (Optional) Select Include usage covered by Reserved Instances and Savings Plans expiring in the next 30 days to have the Savings Plan recommendation include expiring RIs and Savings Plans when building the quote.

Savings Plan recommendations can take a few minutes to be created. Only one recommendation can be created per account, per day.

Review Recommendations for Single Accounts

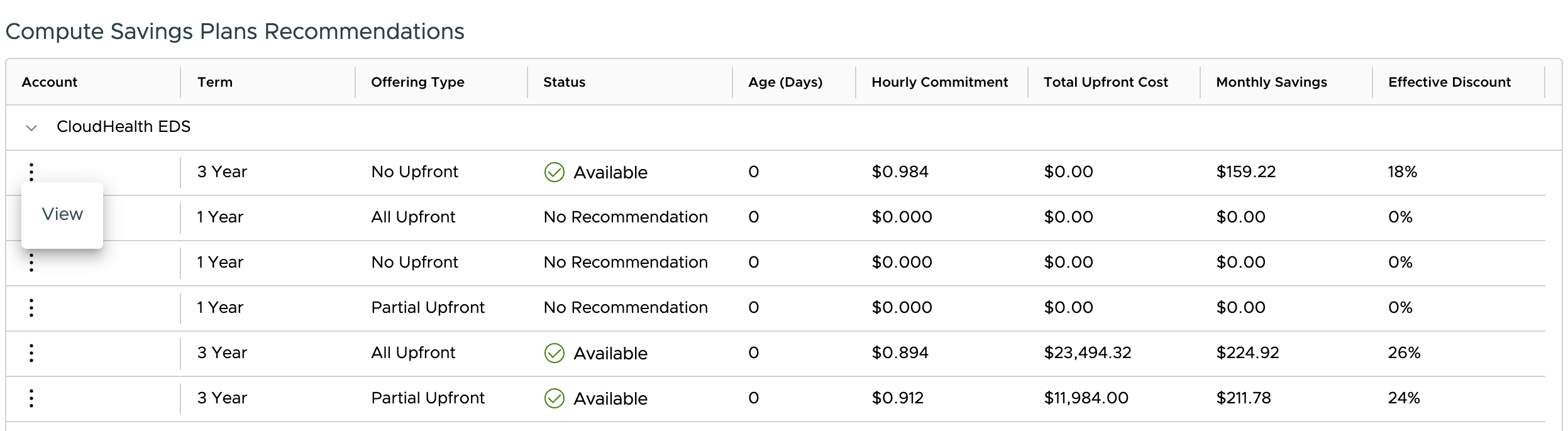

When the single account recommendation scope is selected, you specify the time period and payment option for the quote. Quotes are generated for each account selected.

1 Year No Upfront is the least expensive Savings Plan, but also has the lowest discount compared to On Demand pricing. 3 Year All Upfront is the opposite: it is the most expensive Savings Plan, but also the highest discounts compared to On Demand pricing.

Each quote summary includes the following information:

-

Account: Shows each quote grouped by account selected. You can review quote details for a specific quote by clicking the three dots and selecting View.

-

Term: The payment term selected: 1 year or 3 years

-

Offering: The offering type selected: All Upfront, Partial Upfront, No Upfront

-

Status: Displays one of the following:

- Generating: A recommendation is being created.

- Available: A recommendation was created, and is ready to view.

- No recommendation: A recommendation was created, but it is less cost-efficient. You can still view the details of a quote with a No Recommendation status, and adjust additional parameters within the quote.

- No data: No information was found in the account, and a recommendation could not be created.

-

Age (Days): The last time the quote was generated, in days.

-

Hourly Commitment: The committed spend per hour for the Savings Plan. This is the key attribute you'll need to purchase your Savings Plan, and is associated with the Savings Plan throughout the Plan's lifetime.

-

Total Upfront Cost: The total amount that you must pay upfront for this purchase option.

-

Monthly Savings: How much per month your organization saves by purchasing the Savings Plan, based on the usage in the evaluation period.

-

Effective Discount: The estimated cost savings, in percent.

Review Single Account Quote Details

To review detailed information about a single account quote, select the icon in the Account column, and then click View. You can also change the Recommendation Option and select Refresh to view how your choices impact the quote.

To return to the main Savings Plan Recommendations page, click Back. You can also export the graph or table data as a CSV.

If you decide to purchase the Savings Plan in the quote, you can click Purchase Savings plan to start the process. When purchasing a Savings Plan for a single account, ensure that the IAM policy for the account is set so that CloudHealth has permission from AWS to make the purchase on your behalf.

Review High Level Summary

This section provides an overview of before and after rates for discounts and coverage, as well as the estimated monthly spend and savings with the selected quote.

This section includes the following information about your quote:

- Global Discount Rate (Before): The average discount rate for the billing account across On Demand, Reserved Instances, Spot Instances, and Savings Plans, before the quote is purchased.

- Global Discount Rate (After): The average discount rate for the billing account across On Demand, Reserved Instances, Spot Instances, and Savings Plans after the quote is purchased, based on usage in the evaluation period.

- Total Coverage (Before): The percentage of applicable compute costs covered by Reserved Instances, Spot Instances, or Savings Plans, before the quote is purchased. Uncovered compute costs are charged at On Demand rates.

- Total Coverage (After): The percentage of compute costs covered by Reserved Instances, Spot Instances, or Savings Plans after the quote is purchased, based on usage in the evaluation period. Uncovered compute costs are charged at On Demand rates.

- Estimated Monthly Spend: The estimated amount of money your organization would spend per month after purchasing the quote.

- Estimated Monthly Savings: The estimated amount of money your organization would save per month after purchasing the quote.

Review Detailed Summary

This section provides a chart, detailing how the Savings Plan quote might impact your organization.

The chart tracks the following values:

- Applied Value of Commitment: How much On Demand usage in the evaluation period would be covered by the Savings Plan quote.

- Actual On-Demand Hourly Cost: The actual hourly On Demand usage cost for the evaluation period according to your AWS bill.

- Unused Savings Plan: The estimated amount of Savings Plans that would have gone to waste if you had purchased this quote last month. In a single account quote, this value depends on whether the Discount Sharing setting in the account is enabled. It is normal for some Savings Plans to go unused to get the maximum savings.

- Savings Plan Commitment: The spend per hour amount recommended by the Savings Plan quote.

You can compare the actual On Demand hourly cost with the applied value of commitment to determine how often the Savings Plan hourly commitment amount is higher or lower than the actual usage:

- When the actual On Demand hourly cost is higher than the applied value of commitment, the difference is charged as On Demand.

- When the actual On Demand hourly cost is lower than the applied value of commitment, the difference is lost. Unused hourly commitment does not roll over and cannot be used for a later time period. As a result, you have paid for usage that did not get used.

Depending on your historical usage, it may be impossible to avoid periods when your actual usage does not meet or exceed the applied value of Savings Plan commitment. If the amount of unused Savings Plan commitment concerns you, you can return to the main Savings Plan Recommendations page and lower the total coverage percentage.

The Commitment Impact by Instance Family table details how the quote would affect each instance family in the account. Each column includes the following information:

- RI Coverage (%): The percentage of spend for this product family currently covered by RIs. Does not include any RIs expiring in the past 30 days. If you selected the Include usage covered by Reserved Instances and Savings Plans expiring in the next 30 days checkbox, then the RI Coverage also does not include RIs expiring in the current month.

- Savings Plan Coverage (%): The percentage of spend for this product family that is currently covered by the Savings Plan, and the percentage of spend that will be covered by Savings Plans if the quote is purchased. Does not include any Savings Plans expiring in the past 30 days. If you selected the Include usage covered by Reserved Instances and Savings Plans expiring in the next 30 days checkbox, then the Savings Plan Coverage also does not include Savings Plans expiring in the current month.

- Projected Effective Discount (%): The average discount rate for your billing account, including both RIs and Savings Plans, if you purchase the quote.

- Total Monthly Savings ($): How much you save each month with RIs and Savings Plans, if you purchase the quote.

Savings Plan Example Scenarios

Example 1: Steady Historical Usage

If your historical usage has been steady and mostly unchanged from day to day, CloudHealth can confidently recommend a high coverage Savings Plan. In this scenario, the default recommended Savings Plan would be both high coverage and high cost savings.

However, if you anticipate that your usage levels may drop (or rise), then you should manually adjust the hourly commitment amount or the total coverage percentage to better match your organization's anticipated usage.

Example 2: Varied Historical Usage

If your historical usage fluctuates, resulting in spikes and dips in usage, then CloudHealth recommends a best fit Savings Plan that results in the greatest savings, given the historical usage data, but not necessarily the highest coverage. If a Savings Plan commitment is high enough to cover all the spikes in usage, then your organization loses money when the usage drops. The default recommended Savings Plan anticipates some periods where the Savings Plan commitment amount exceeds the hourly usage amount - resulting in unused commitment - but overall results in the greatest cost savings for your organization.

Example 3: Historical Usage with High and Low Discount Workloads

If your historical usage includes both workloads that get high Savings Plan discounts and workloads that get low Savings Plan discounts, the discount rate varies more drastically as you configure higher and lower coverage rates or commitment amounts.